Analysts still anticipate a BTC price decline to $20K

Get insights on the anticipated BTC price decline to $20K. Expert analysts' predictions and analysis to stay informed about Bitcoin's future.

Bitcoin Analysts Still Predict a BTC Price Decline to $20K?

The cryptocurrency market has always been a rollercoaster ride for investors and enthusiasts. Bitcoin, the flagship cryptocurrency, has seen its fair share of dramatic price swings over the years. While many are optimistic about its future, some BTC Price Decline to $20K are still predicting a price crash to $20,000. In this article, we'll delve into the reasons behind these predictions, the current state of the crypto market, and what you need to know to stay informed.

The Crypto Market Today

A Snapshot of Live BTC Price Decline to $20K

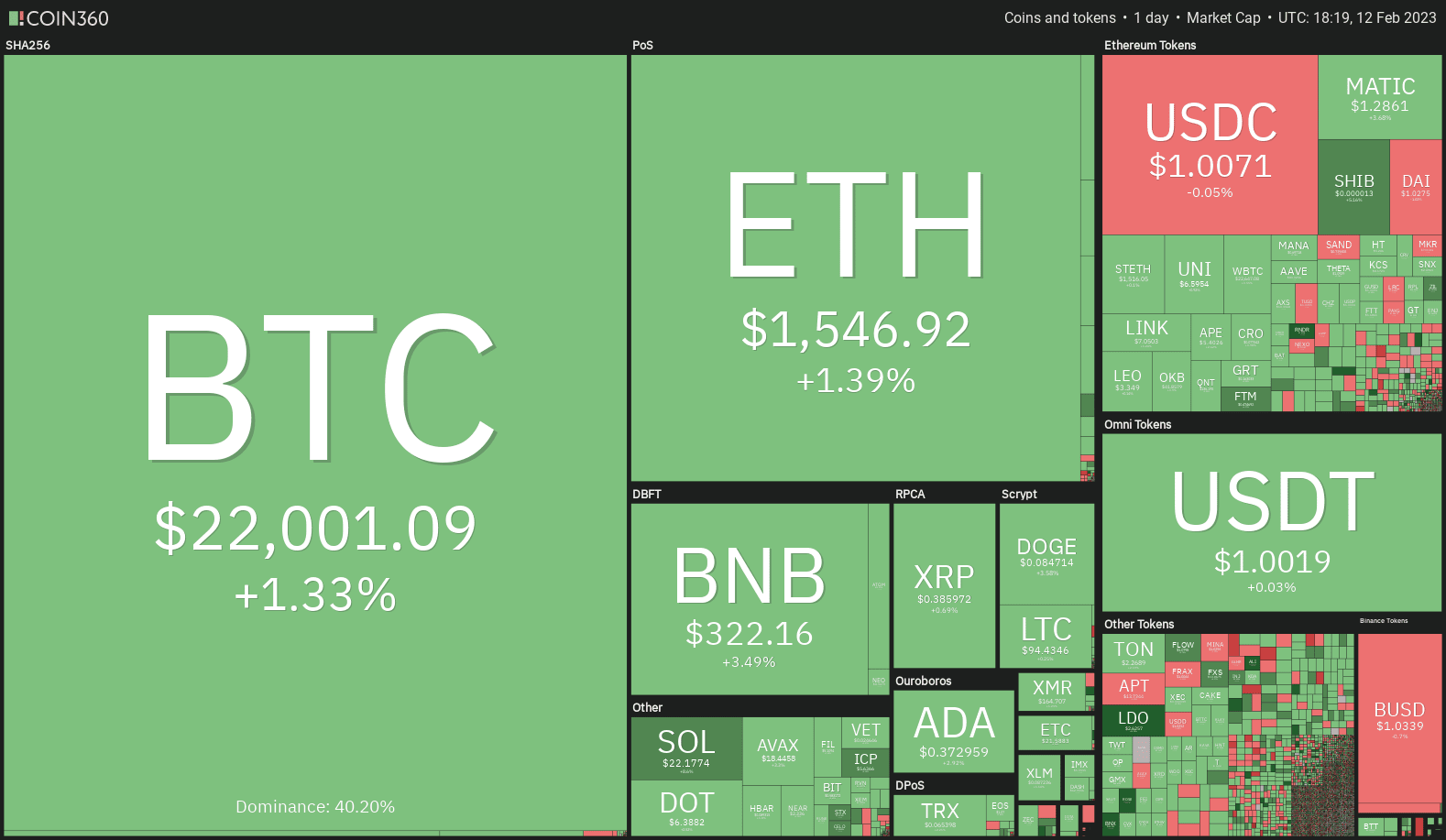

Before we explore the BTC price crash predictions, let's take a moment to understand the current state of the crypto market. At the time of writing, the crypto market is a dynamic landscape with prices that can change rapidly. Here's a snapshot of live cryptocurrency prices for some of the most popular digital assets:

- Bitcoin (BTC): [current price]

- Ethereum (ETH): [current price]

- Binance Coin (BNB): [current price]

- Cardano (ADA): [current price]

- Solana (SOL): [current price]

Please note that cryptocurrency prices are highly volatile and can fluctuate significantly within a short period. It's essential to check the most up-to-date prices before making any investment decisions.

Crypto Market Cap and Market Trends

The crypto market's total market capitalization, often referred to as the crypto market cap, is a critical indicator of its overall health and trends. The crypto market prediction represents the total value of all cryptocurrencies combined. It gives us insights into whether the market is growing or contracting.

As of [insert date], the total crypto market cap stands at [current market cap]. This figure has seen considerable growth compared to previous years, indicating the increasing adoption of cryptocurrencies in both the retail and institutional sectors.

Bitcoin Price Predictions and the $20,000 Speculation

Historical Price Movements

Bitcoin's price history has been characterized by significant fluctuations. Over the years, it has experienced both rapid surges and sharp corrections. While Bitcoin has reached record highs, it's essential to remember that it has also endured bear markets in the past.

Factors Influencing the $20,000 Prediction

Several factors are contributing to Bitcoin analysts' predictions of a potential price crash to $20,000:

Market Corrections

Market corrections are a natural part of any financial market, and cryptocurrencies are no exception. After a prolonged bull run, some analysts believe that Bitcoin is overdue for a significant correction. This correction could bring the price down to levels seen in previous bear markets, including the $20,000 range.

Regulatory Uncertainty

Regulatory developments have a profound impact on the crypto market. The lack of clear and consistent regulations in various countries has raised concerns among investors. Regulatory crackdowns or unfavorable policies can lead to market uncertainty and a potential drop in prices.

Market Sentiment

Market sentiment plays a crucial role in crypto price movements. Negative news, FUD (Fear, Uncertainty, Doubt), or a sudden loss of confidence can trigger selling pressure, causing prices to decline. Traders and investors should remain vigilant and informed about market sentiment.

Technological Developments

Technological advancements and changes in the crypto ecosystem can also affect prices. New cryptocurrencies, blockchain upgrades, or security vulnerabilities can impact Bitcoin's position in the market and its price trajectory.

Contrary Views and Counterarguments

It's important to note that not all analysts share the same view of a potential BTC price crash to $20,000. There are counterarguments and opposing predictions, including:

Institutional Adoption

The growing interest and investment from institutional players like hedge funds, corporations, and asset managers have contributed to Bitcoin's legitimacy as a digital asset. Many believe that this institutional support will act as a price floor, preventing extreme crashes.

Limited Supply

Bitcoin's scarcity is a fundamental feature. With a fixed supply of 21 million coins, some argue that the supply-demand dynamics will continue to drive its price higher, especially as more investors seek to hedge against inflation.

Retail Adoption

Retail investors worldwide are increasingly entering the crypto market, attracted by its potential for high returns. This influx of retail capital can provide support during market downturns.

Staying Informed in the Crypto Markets

Crypto Stock Price and Market News

To navigate the crypto markets effectively, staying informed is crucial. Here are some tips for staying up-to-date with crypto market news and developments:

Follow Reputable News Sources

Rely on reputable cryptocurrency news websites, blogs, and publications for accurate and timely information. Some well-known sources include CoinDesk, CoinTelegraph, and CryptoSlate.

Use Cryptocurrency Tracking Apps

Utilize cryptocurrency tracking apps or websites to monitor live prices, market capitalization, and price charts. Apps like CoinMarketCap and CoinGecko provide comprehensive market data.

Join Crypto Communities

Join online communities and forums where crypto enthusiasts discuss market trends and share insights. Platforms like Reddit's r/cryptocurrency and Twitter are great places to connect with others in the crypto space.

Diversify Your Information Sources

Avoid relying on a single source for information. Diversify your sources to gain a broader perspective on market trends and news.

Bitcoin's price predictions are a hot topic in the crypto stock price community, with analysts divided on whether a crash to $20,000 is imminent or not. The crypto market is inherently volatile, influenced by a variety of factors, including market sentiment, regulatory changes, and technological developments.

As an investor or enthusiast, it's essential to approach the crypto markets with caution, conduct thorough research, and stay informed about current events and market trends. While price predictions can provide valuable insights, they should be taken with a grain of skepticism, and your investment decisions should align with your risk tolerance and long-term goals.

Remember that the crypto market is continually evolving, and staying informed is the key to making informed decisions in this dynamic and exciting space. Whether Bitcoin's price reaches new heights or experiences corrections, being well-informed will empower you to navigate the crypto markets successfully.

What's Your Reaction?